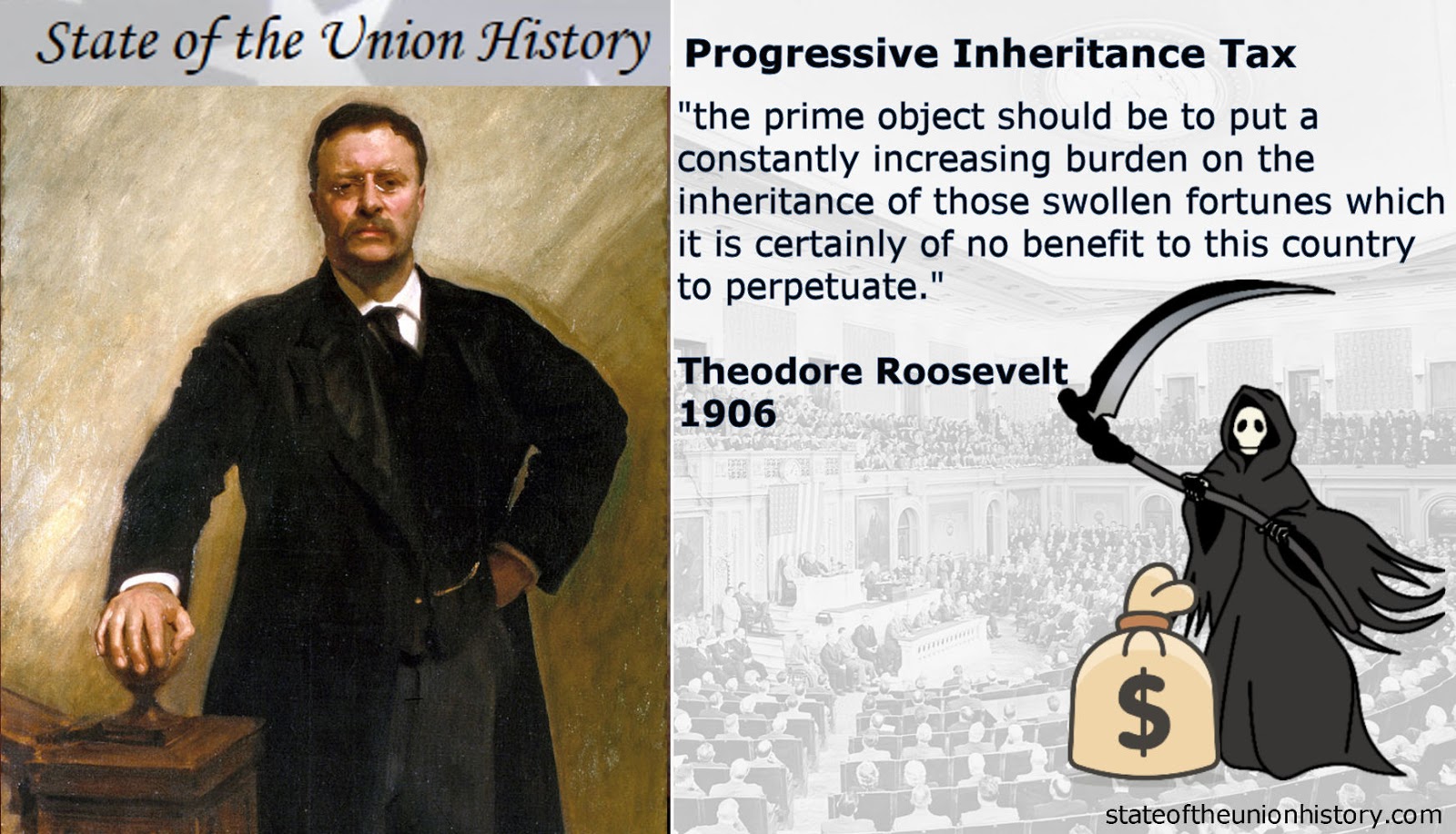

State of the Union History: 1906 Theodore Roosevelt - Progressive Inheritance Tax (protecting thrift and ambition)

Franklin D. Roosevelt | Accomplishments, New Deal, Great Depression, World War II, & Death | Britannica

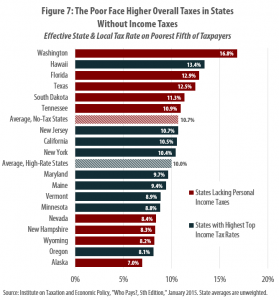

Trickle-Down Dries Up: States without personal income taxes lag behind states with the highest top tax rates – ITEP

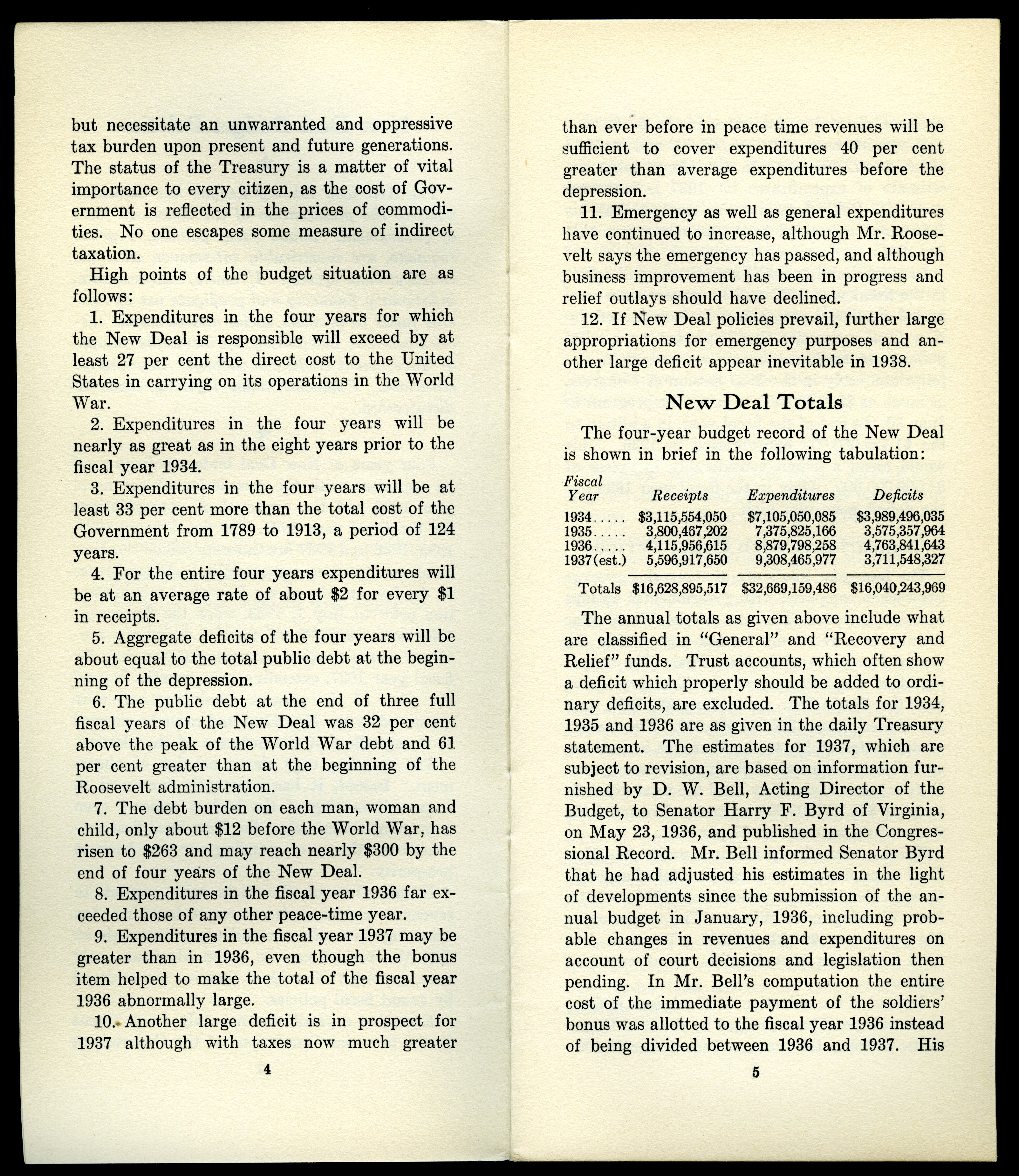

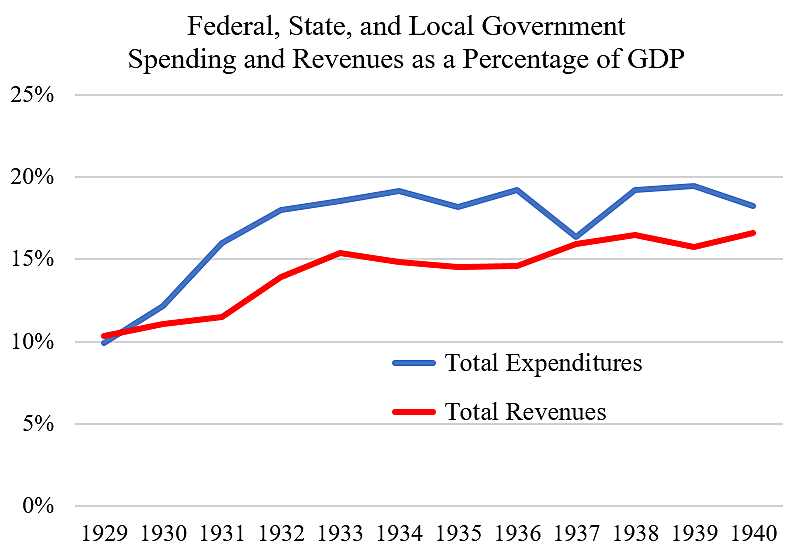

No. 130 "New Deal Budget Policies: A Review of the Huge Expenditures under the Roosevelt Administration and the Alarming Increase in the National Debt…

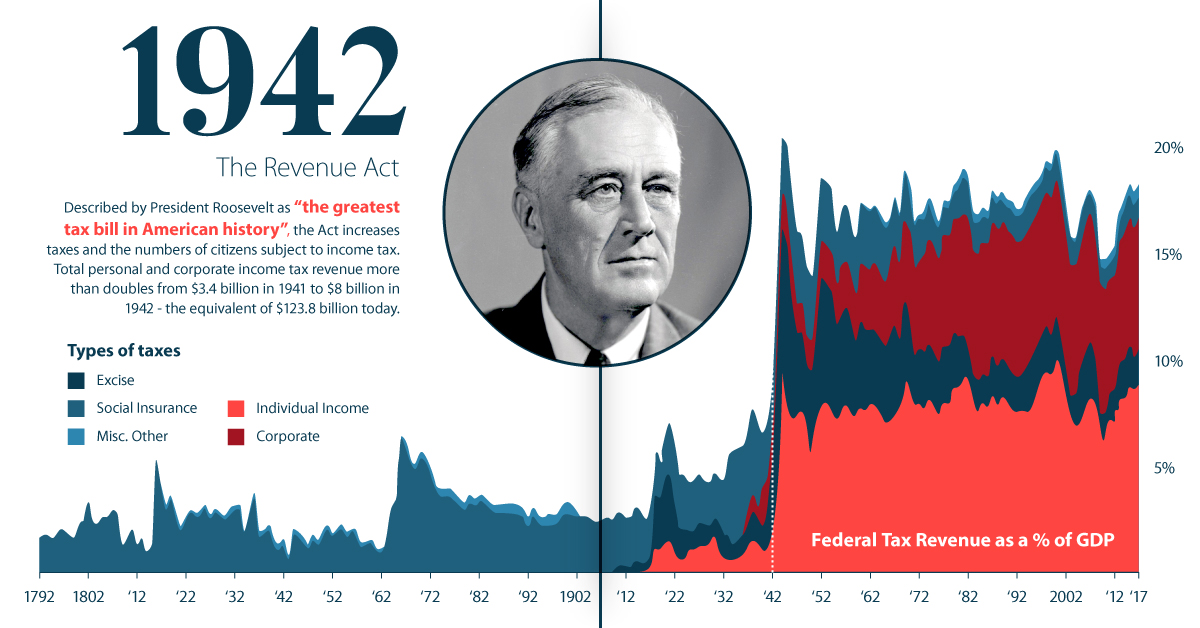

:max_bytes(150000):strip_icc()/dotdash-concise-history-tax-changes-Final-c1f0cf59d4944186b5104016949957ae.jpg)